FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The high degree of leverage can work against you as well as for you. Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. Please read our privacy policy and legal disclaimer. The use of this website constitutes acceptance of our user agreement. Note: All information on this page is subject to change. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author makes no representations as to the accuracy, completeness, or suitability of this information. The author has not received compensation for writing this article, other than from FXStreet.įXStreet and the author do not provide personalized recommendations. If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author will not be held responsible for information that is found at the end of links posted on this page. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. It also does not guarantee that this information is of a timely nature.

Determine trend 200 ema free#

FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. You should do your own thorough research before making any investment decisions. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

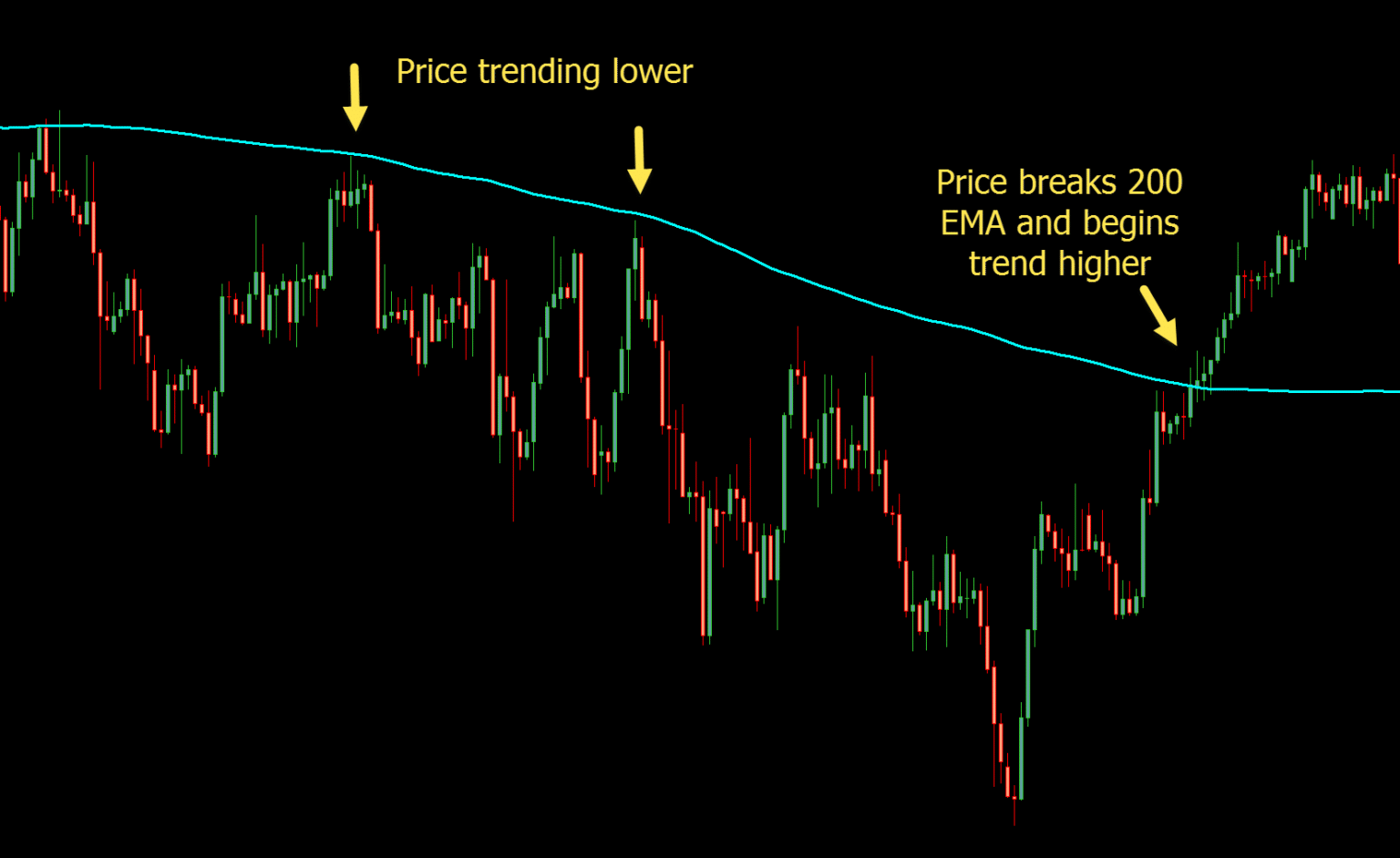

Information on these pages contains forward-looking statements that involve risks and uncertainties. In a case where the quote remains bearish below 132.90, the previous monthly low of 127.21 will be in the spotlight. Though, multiple levels near 31.30-20 and the 130.00 round figure could challenge the USD/JPY pair’s downside past 132.90. Meanwhile, a downside break of the 133.80 support confluence could quickly drag the USD/JPY price towards an early month swing high near 132.90. Though, the 140.00 psychological magnet may challenge the Yen pair buyers afterward. That said, the recent top surrounding 135.10, marked on Friday, acts as an extra filter towards the north past 100-day EMA.įollowing that, a run-up towards mid-December 2022, close to 138.20, can’t be ruled out. It’s worth noting, however, that the bullish MACD signals and higher low bullish formation on the daily chart keep the USD/JPY pair buyers hopeful.

However, the 100-day EMA level surrounding 134.75 guards nearby the upside.

That said, the 200-day Exponential Moving Average (EMA) joins an upward-sloping trend line from February 02 to restrict the USD/JPY pair’s immediate downside near 133.80. In doing so, the Yen pair also prints mild gains near the highest levels in two months, poked on Friday. USD/JPY seesaws around intraday high near 134.40 as bulls keep the reins for the third consecutive day amid early Tuesday morning in Europe.

0 kommentar(er)

0 kommentar(er)